With pet ownership on the rise in the United States, the pet care industry continues to present lucrative opportunities for investors. According to the American Pet Products Association (APPA), an astounding 82 million U.S. households now own a pet, driving a surge in demand for pet products and services.

The APPA’s 2024 National Pet Owners Survey projects that Americans will spend a whopping $150.6 billion on their pets this year, up from $147 billion in 2023. As the pet industry expands, investing in pet stocks could prove to be a wise decision for those looking to capitalize on this growing market.

The Growing Pet Care Market

The increasing humanization of pets, where owners treat their animals as family members, has significantly boosted spending in this sector.

James Lewis, a senior equity research analyst at Bartlett Wealth Management, highlights the loyalty customers show to pet brands, contributing to a robust market with lower development costs compared to products designed for humans. Lewis states, “The animal health market benefits from the global trend of pet humanization.”

For investors, this translates into potential growth in pet stocks within the pet care industry. Let’s dive into six companies that could be worth watching in 2024.

Also Read:- Hearty by HUFT: Revolutionizing Pet Nutrition in India

1. Zoetis Inc. (ZTS)

Leading the Pet Pharmaceuticals Market

Zoetis Inc. is a global leader in animal health, specializing in pharmaceuticals for pets and livestock. With a market capitalization of $83.6 billion, Zoetis is a significant player in the S&P 500.

The company has a track record of innovation, introducing products like Apoquel, a derma relief medicine for dogs, and Librela, a pain reliever for canine osteoarthritis.

These innovations have driven revenue growth, with an 8% increase to $2.4 billion in the last quarter.

Analysts have raised their guidance for Zoetis, with some predicting a share price north of $200 by year-end, supported by a $6 billion share buyback program.

2. Chewy Inc. (CHWY)

The E-commerce Giant Facing Volatility

Chewy Inc., well-known for its blue cardboard boxes, is a major player in the online pet supply space.

After reaching profitability in 2023, the company’s earnings are expected to grow in 2024 before potentially declining in 2025.

Despite the recent volatility in its pet stocks price, which saw a sharp rise and fall due to meme trading activity, Chewy remains a household name among pet owners.

However, analysts at Bank of America have an underperform rating on the stock, citing concerns about slowing consumer trends and a high price-to-earnings (P/E) ratio that could indicate an overvaluation.

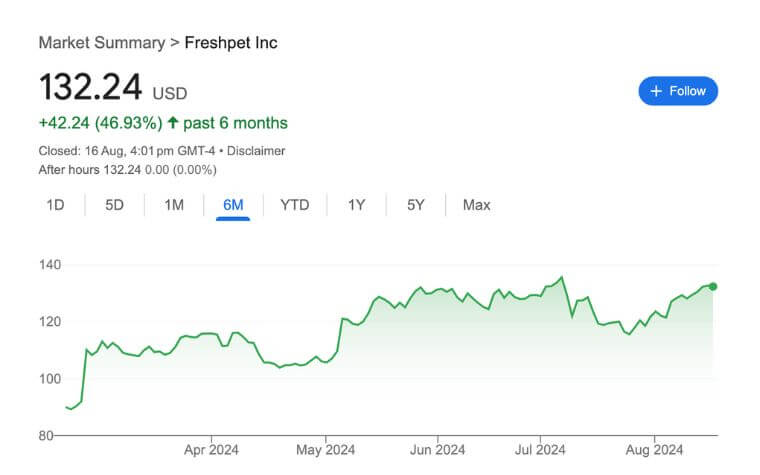

3. Freshpet Inc. (FRPT)

Revolutionizing Pet Nutrition with Fresh Food

Freshpet Inc. is carving out a niche in the pet food market with its refrigerated, fresh pet food offerings.

The company is expected to turn a profit for the first time in a decade, driven by strong sales growth and positive market trends.

While the stock’s forward P/E ratio of 101 suggests it’s expensive, the growth prospects are strong. Sales have been growing at double-digit rates, fueled by the trend of pet humanization.

Freshpet’s target market, high-income consumers willing to spend on premium products, is helping the company maintain its bullish momentum.

Also Read:- Global Pet Clothing Market Size to Reach USD 9.87 Billion by 2033

4. Petco Health and Wellness Co. Inc. (WOOF)

Struggling to Regain Its Footing

Petco, a familiar name in the pet retail space, has been facing challenges with declining earnings.

The company recently appointed Joel Anderson as CEO, a move that could spark new growth.

However, the stock’s technical indicators are currently bearish, trading below its long-term moving average.

Petco is attempting a turnaround, but with $2.98 billion in debt and declining sales, the road ahead looks challenging.

The company’s market capitalization is now just $623.8 million, reflecting the difficulties it faces.

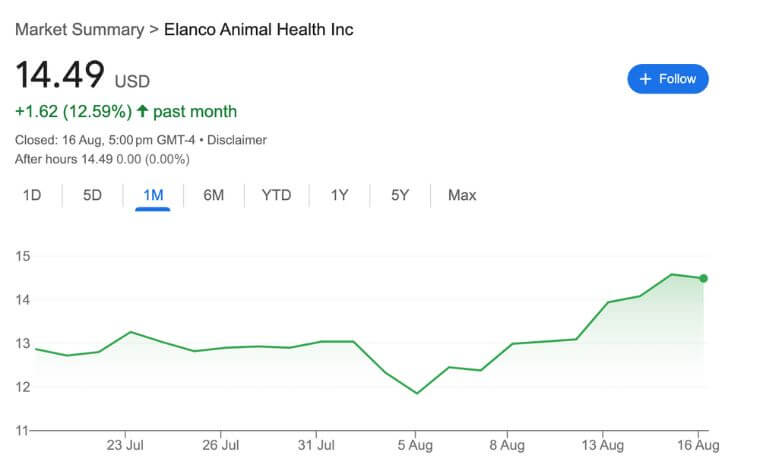

5. Elanco Animal Health Inc. (ELAN)

Growth Through Strategic Acquisitions

Elanco Animal Health Inc. is a key player in the pet disease prevention market, with well-known brands like Seresto and Advantage.

The company has seen steady profitability since going public in 2018, supported by strategic mergers and acquisitions, including the $6.9 billion acquisition of Bayer Animal Health.

In 2024, Elanco sold its Aqua business to Merck Animal Health for $1.3 billion, using the proceeds to pay down debt.

With revenue growing by 12% in the latest quarter and adjusted earnings up by 67%, Elanco’s stock is poised for potential growth, with analysts estimating a valuation north of $20 per share.

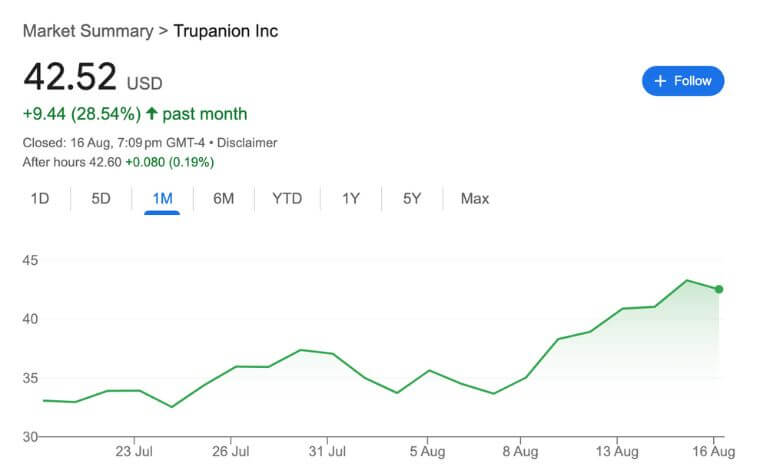

6. Trupanion Inc. (TRUP)

Betting on Pet Insurance for Future Growth

Trupanion Inc., a provider of pet health insurance, is yet to turn a profit but is showing signs of potential.

Analysts expect the company to achieve profitability by 2025, as revenue continues to grow, albeit at a slower pace.

The recent appointment of Margi Tooth as CEO could provide the leadership needed to steer the company toward profitability.

The pet stocks has started to outperform the S&P 500, with positive long-term and near-term price momentum.

Despite challenges, including a recent cut in earnings estimates, Trupanion could be an interesting play in the fast-growing pet insurance market.

Also Read:- Woman in Her 30s Dies in Coventry Pet Dog Attack

Conclusion of Pet Stocks

The pet care industry offers diverse opportunities for investors, from pharmaceutical companies like Zoetis to retail giants like Petco.

As pet ownership continues to grow, these companies are well-positioned to capitalize on the increasing demand for pet products and services.

However, investors should remain cautious, as some pet stocks in this space may face volatility and challenges in the coming year.